If you’re looking to make the process of managing your loan pipeline less complicated and more efficient, then investing in loan pipeline software is a smart choice. It’s not just a way to save time and effort but improves accuracy throughout the entire process by ensuring that every transaction is properly recorded and secured. Additionally, using technology to automatize certain processes will reduce the manual work involved during the approval and onboarding of loans. This will result in efficiency that will benefit both lenders as well as borrowers.

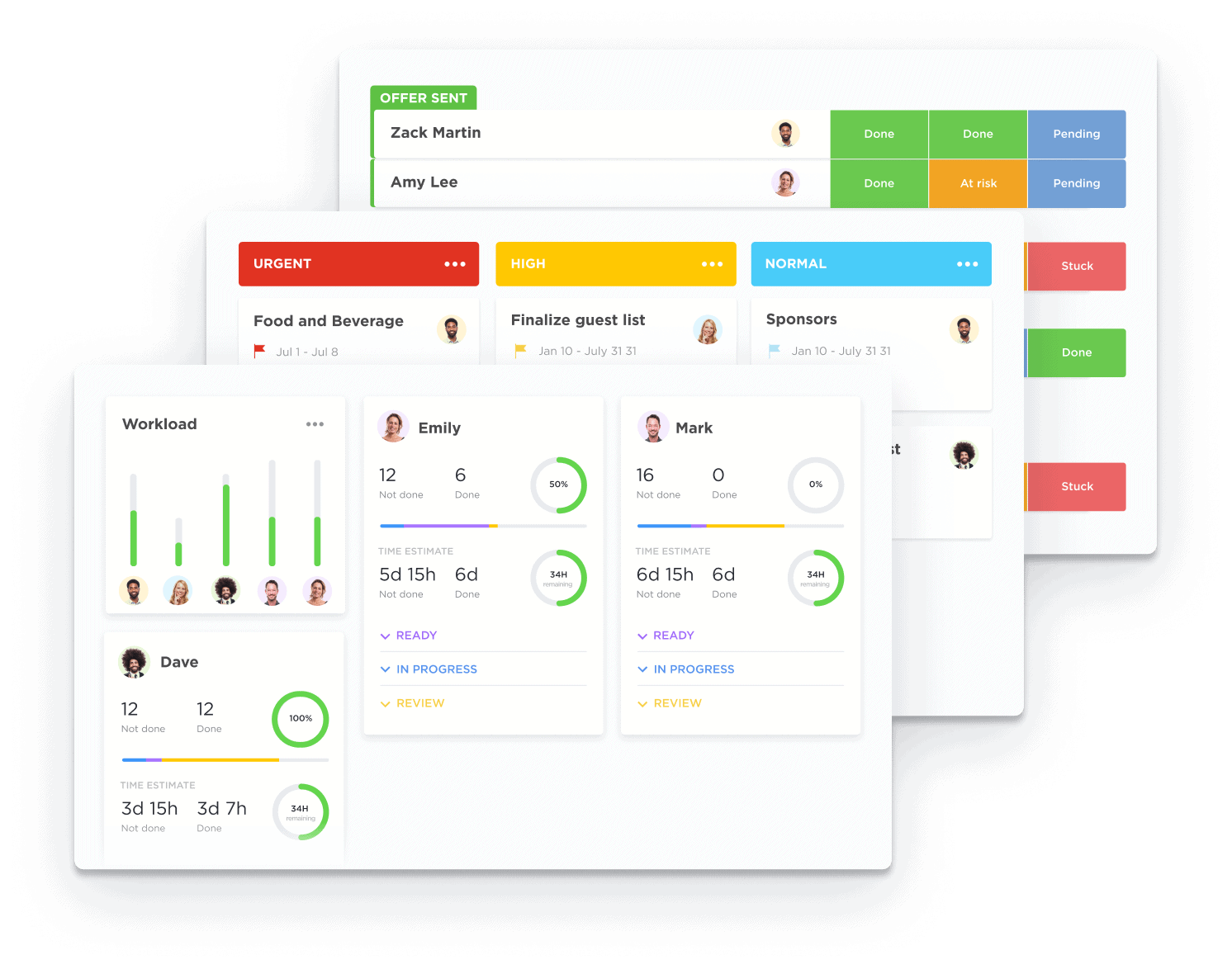

Automated tracking systems and management software help monitor and manage loan transactions from the time of their origin until the time of closing. Automated reports and documents can be generated electronically, which guarantees greater accuracy and efficiency over the lifetime of a business. This helps save time and energy. Furthermore, technology can automate certain processes for onboarding and reduce manual work for both the lender as well as the borrowers. Software for loan pipelines can be particularly useful in increasing liquidity management by providing users access to real-time collaboration features as well as connected data reporting capabilities. It is also possible to use this technology to enhance customer service. The software allows you to manage your customer relationships by providing friendly customer support, automated processes, and secure document sharing.

To be successful, loan agents must have good relationships with their customers and keep continuous communication. If lenders do not have a CRM, they may struggle to keep all of their contacts, as well as associated documents, as well as other information. A CRM assists in organizing information about customers in one location in order to make it easy to get their contact information easily send out emails or notifications, track the process of loan applications make your job easier, produce reports, and more. A CRM allows loan agents to simplify their processes, and also provide top-quality service, while also cutting down on time. This is why the investment in a CRM is vital for any loan agent seeking to effortlessly manage their clients and successfully close loans.

Financial institutions have discovered loan pipeline software to be an effective tool, as it makes it easier to create and send loan orders. The software is able to automate the processing of loan requests and improve accuracy. The benefits of this software are not just efficiency, but also improve customer service. The software provides immediate updates on loan status and ensures that loans are being approved promptly. Additionally, it can help reduce operating costs as mistakes made by hand are reduced and fewer resources are needed for staff members to complete tasks. This software is customizable to suit the needs of an organization for data reporting and communication. Companies can rest assured that the security of sensitive information is secured from being tampered with by outsiders thanks to enhanced security features.

Improve the efficiency of your company

Software that helps automate the administration of your loan pipeline is ideal to make your company more efficient. It lets you track your organization, and manage and monitor the entire loan process from beginning to finish efficiently and quickly. Automating the process saves time, and money and reduces manual labor. Software that automates loan application processing will help improve customer service by simplifying the process and speeding up the process of making decisions. It also helps minimize human error as well as provides transparency into every aspect of the loan life cycle. This kind of software could aid you in gaining an edge on the market.

Simple and affordable

Loan Pipeline Software is great for customers on a budget because it provides simple and affordable solutions to manage your loan servicing. The program provides all of the tools necessary to track the loan information of your borrower including payment information along with other documents and other information, all on one platform. Loan Pipeline is especially helpful for companies with large amounts of data. This program allows several users to work together from different locations and gives them access to their data at any time they need it. Loan Pipeline Security features provide security for sensitive data from unauthorized third-party access. Loan Pipeline is an excellent solution for those who are looking for an affordable solution but don’t sacrifice quality or security.

You can run your business anyplace

Software that allows you to manage your loan pipeline has revolutionized the way companies are managed. The loan tracker technology allows us to keep track of projects and loan applications remotely and makes it easier to run a business no matter where you’re located. Loan software offers you comprehensive current information about your prospects, clients of loan performance, progress on loans, and performance. With the most up-to-date information and insight into your business, it is possible to access vital information about your customers which are difficult to track manually in an office setting. For business owners who want to remain agile and mobile no matter where they live and work, loan tracking is an invaluable resource. There are many benefits to the software for loan pipelines, and that’s why it is an essential element of any loan management system.

For more information, click perfect pipeline management tool